The events of the last few weeks in Ukraine have been stressful and upsetting to many of us. The buildup of Russian forces along the border, rising tensions, and the ensuing attack have caused worldwide shockwaves. People across the globe are understandably concerned and anxious.

What’s more, the events have caused economic volatility across the world, with Russia’s currency dropping to historic lows against the dollar and the Russian stock market issuing an emergency closure. (1) On February 24th, the European Stock Market Volatility Index, which measures the expectation of volatility over the next 30 days, neared a 20-year high. (2)

While hopes are high for talks aimed at deescalating the crisis, the financial implications may be considerable. Tough financial sanctions aimed at Russia could lead to an increase in retaliatory cyberattacks. In addition to the conflict in Ukraine, our economy is facing high inflation and continued uncertainty about COVID variants. Even with the DOW’s strong rally at the end of last week, the three major U.S. averages are on track for a loss of roughly 4% each for February. (3)

Financial Markets and Geopolitical Events

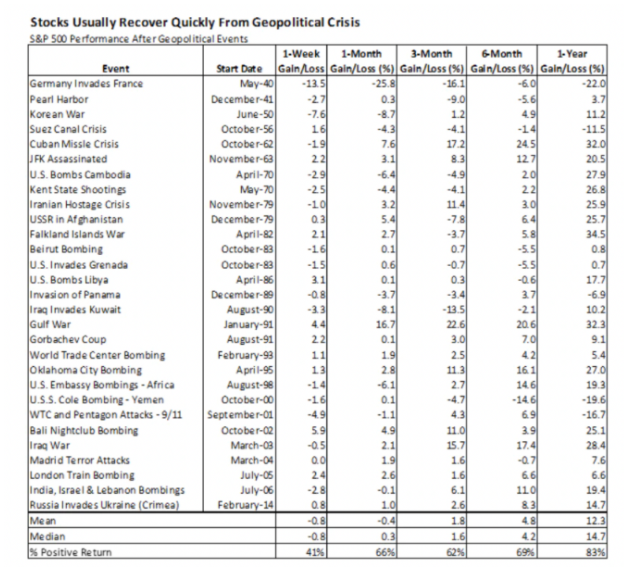

Events around the world can quickly shock financial markets, but the reality is that markets often tend to recover rather quickly from external shocks. In fact, since World War II, stock markets typically rebounded within 3 months of a large geopolitical shock. The average time for markets to rebound after major geopolitical shocks is around 47 days. (4) In fact, the U.S. stock market regained losses within 30 days of the September 11th attacks. (5)

Take a look at the following chart to see how stocks typically recover following geopolitical crises: (6)

What to Do During Market Declines

What to Do During Market Declines

While market declines can be scary, especially for those within retirement, the reality is that these declines often create valuable opportunities. Short-term price drops for companies with excellent long-term value offer a great chance to invest or rebalance. Because markets are prone to quickly recover after geopolitical shocks, it’s critical not to sell during short-term downturns.

Stay Calm

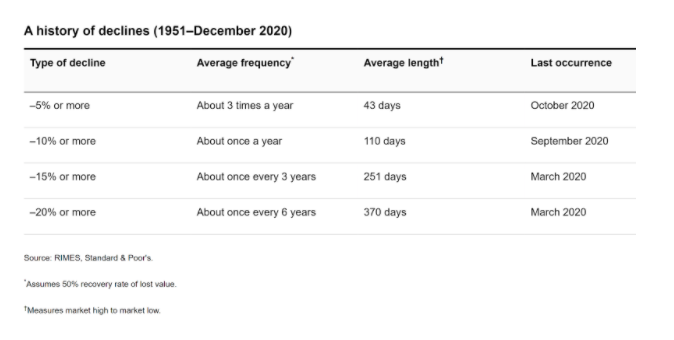

While the current conflict is stressful to many, your long-term investment plan should not be a source of fear. At times like these, it’s important to put current conditions into perspective. This is not the first time the market has taken a tumble and it won’t be the last. Declines in the Dow Jones Industrial Average are actually fairly regular events. In fact, drops of 10% or more happen about once a year on average: (7)

Play Dead

Play Dead

There’s an old saying that the best thing to do when you meet a bear market is the same as if you were to meet a bear in the woods: play dead. While easier said than done, successful long-term investors know that it’s important to stay calm during a market decline.

Market volatility has increased in recent years and it may seem like each episode is worse than the one before. In reality, volatility does not hurt investors, but selling when the market is down will lock in losses.

Remember That Your Portfolio Is Diversified

Fears about war and market declines are stressful. However, it is important to keep in mind that while the stock market is down, your portfolio is made up of both stocks, bonds, and other assets that are designed to work together to decrease overall losses. It’s important to consider your specific portfolio, investment horizon, and circumstances when reflecting on economic events. If you have questions about your portfolio, get in touch with our office.

Review Your 401(k) and Other Accounts

Now is a good time to take a look at all of your investment accounts, including your 401(k) to make sure it is well diversified. If you have not rebalanced your other investment accounts in the last year, get in touch with our office and we’ll take a look and offer recommendations to minimize potential losses.

Speak With Your Advisor

Whether you’re new to investing or an experienced investor, it’s helpful to consult with an objective third party. Human nature causes us all to act out of emotion when our accounts go down. As an independent firm, we put your best interests first. We seek to serve as a support system for our clients, helping them make informed financial decisions that aren’t driven solely by emotion.

We’re Here for Your Friends and Family

If you have friends or family who need help with their investments, we are happy to offer a complimentary portfolio review and recommendations. We can discuss what is appropriate for their immediate needs and long-term objectives. Sometimes simply speaking with a financial advisor may help investors feel more confident and less concerned with the day-to-day market activity. Schedule your complimentary introductory meeting by emailing me at [email protected], calling (417) 351-2942, or using my online calendar.

About Michael

Michael Vaughn is a CERTIFIED FINANCIAL PLANNER™ professional and Vice President at Pinnacle Family Advisors (PFA) with 21 years of industry experience. Before joining the PFA family, he served clients with investment management and retirement planning at The Mutual Fund Store for 14 years. Michael graduated from Missouri State University with a bachelor’s degree in business administration and management and earned his CFP® certification in 2004. He also served 20 years in the Missouri National Guard, retiring in 2007 as a Major. He currently volunteers on the board of directors for Good Dads and Fellowship of Christian Athletes. Michael is married to Lori and they have two daughters. To learn more about Michael, connect with him on LinkedIn.

____________

(1) https://www.cnn.com/2022/02/28/business/russia-ruble-banks-sanctions/index.html

(3) https://www.cnbc.com/2022/02/22/stock-market-futures-open-to-close-news.html

(4) https://seekingalpha.com/article/4488660-how-stock-market-reacts-war-based-crash

(7) https://www.capitalgroup.com/individual/planning/market-fluctuations/past-market-declines.html