By Michael Vaughn, CFP®

A financial plan created for you and tailored to your unique life goals is like an instruction manual for your finances and your goal achievement. The financial plans we write for our clients include a thorough analysis of your goals and your resources and the likelihood of meeting your goals if you change nothing. The plan also includes projections—what your situation could look like if you take our recommendations. We use the Monte Carlo simulation to determine the path that gives you the most likely chances for achieving your goals and the least chance of outliving your resources.

It’s hard to know if something will be worth your time and money without seeing it firsthand before you make a decision. But it’s no easy task to develop a custom financial plan without working with you extensively. That’s why we’ve created a detailed and comprehensive sample financial plan as a sneak peek into what you’d receive when you work with us.

Why Create a Financial Plan?

A financial plan is your road map to the financial life you want. You can’t get where you want to go if you don’t know how to get there, right?

A financial plan takes away the day-to-day and even year-to-year worry you may experience without a clear financial blueprint. With a plan in place, you’ll know easily if you’re on track or not and where and how to make adjustments. Your financial plan is your instruction manual to guide you toward your dreams.

A solid financial plan written in conjunction with a financial professional can give you confidence and peace. It’s a great feeling to know your money has certain responsibilities and that unexpected events won’t rattle your accounts to the core. Whether the markets are up or down, your plan will be in place to guide you. And we’re always a phone call or a meeting away to make adjustments as necessary.

What Does a Financial Plan Include?

First, you may be wondering about what goes into a comprehensive plan. Financial plans often address a myriad of concerns and goals, from tax planning to retirement income strategizing. Depending on your needs, your plan may narrow in on one element or address multiple goals you’d like to pursue over time.

Whatever you choose to focus on, your financial plan is designed to serve as your road map, helping you pull all the moving parts of your finances together so you can navigate the years before, during, and after your transition to retirement.

We believe a good financial plan should give you a detailed, complete view of your current financial situation, a thorough modeling of where you want to be, and the actions you need to take to pursue those goals with confidence.

It should address all the pieces of your financial puzzle, from stresses and fears to your values and dreams, and include risk factors, cash flow, retirement, estate planning, taxes, education, and income strategies to help bring you clarity and guidance. Our financial planning will touch on estate planning and tax planning. I recommend you visit with an estate attorney and a tax professional for more in-depth resources.

It is through our planning process that we help you address life’s expected and unexpected circumstances. The result is a straightforward yet powerful road map to guide you toward financial freedom.

See a Sample Financial Plan

We’ve developed a sample financial plan that reflects our planning process. It looks at a fictional person’s lifestyle income plan and how we developed it, including identifying their goals, creating a balance sheet, reviewing their cash flow, and more.

Keep in mind that this is only a hypothetical plan presented to illustrate what a client’s plan may resemble should they work with us. George and Martha Sample are completely fictional and the plan was put together for illustrative purposes only. Be sure to seek the advice of a qualified professional for your particular situation and not rely upon any of the information herein to make personal financial decisions.

Likelihood of Success: The Monte Carlo Simulation

There are plenty of data points to analyze and build the plan around. But one of the first stops in our planning journey is analyzing how well George and Martha are set up to meet their goals based on what they’re currently doing. That will help direct our focus of where and how to improve their financial plan. To do this, we use a Monte Carlo simulation, which runs 1,000 trials of all the variables to predict potential outcomes.

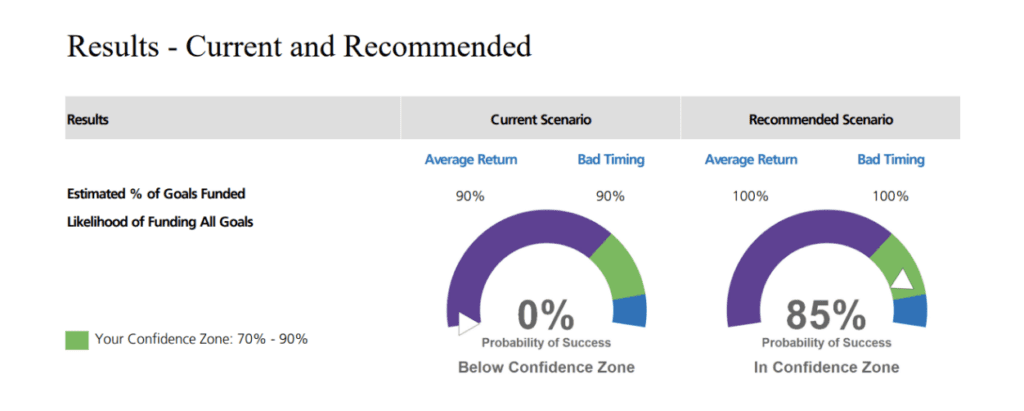

As we can see below, George and Martha have a 0% probability of success with their current financial plan. That doesn’t allow for a workable life plan. But our plan addresses the concerns with their current plan to get them to an 85% probability of success.

Below is a snapshot of the financial goals and expenses in our sample plan for George and Martha (yours will look different). This graph is valuable because you’ll be able to see your goals against the cost of those goals over the course of your retirement. It shows the amount of money you’re projected to need each year to accomplish your goals. The graph is using after-tax, future dollars.

During financial plan creation, it’s important to include all assets and liabilities you currently have. Leave nothing out. The graph below is a Net Worth Summary including all of the sample individuals’ resources like employer’s retirement funds, individual retirement funds, and any liabilities.

The Net Worth Summary is helpful in visualizing the amount you own (your assets) against the amount of debt you hold (your liabilities). Of course the goal is always to have fewer liabilities than assets. As you can see, George and Martha have a total of $240,000 in investment assets (the green bar) and no liabilities. Therefore, they have a net worth of $240,000. They are doing very well without any liabilities (debt).

The image below shows the actual Resource Summary using real dollar amounts. It also shows what resources are assigned to what goals. In the case below, all the resources are assigned to the couple’s goals. It also shows the details pertaining to how and when the couple will begin claiming Social Security benefits—a major piece of financial planning. You’ll always benefit from being proactive about your long-term financial planning.

Below you can see the summary for the Goal Assignment. In this case, the goal is to fund all goals with the couple’s 401(k), Roth IRA, and Social Security payments.

Together with you, Pinnacle Family Advisors creates a comprehensive, detailed plan for your financial future.

Ready to Take the Next Step?

Take a look through our full sample plan here to see how our proven process can help you pursue your own goals and financial freedom. Once you’ve reviewed, give us a call and we can discuss further how we can create a tailored financial plan for you. If you’re already a client with a current plan, let’s review it so it is up to date. Schedule your complimentary meeting by emailing me at [email protected], calling (417) 351-2942, or using my online calendar.

About Michael

Michael Vaughn is a CERTIFIED FINANCIAL PLANNER™ professional and Vice President at Pinnacle Family Advisors (PFA) with 21 years of industry experience. Before joining the PFA family, he served clients with investment management and retirement planning at The Mutual Fund Store for 14 years. Michael graduated from Missouri State University with a bachelor’s degree in business administration and management and earned his CFP® certification in 2004. He also served 20 years in the Missouri National Guard, retiring in 2007 as a Major. He currently volunteers on the board of directors for Good Dads and Fellowship of Christian Athletes. Michael is married to Lori and they have two daughters. To learn more about Michael, connect with him on LinkedIn.