Having employee benefits is a great perk, but if you know all the ins and outs, the chances of maximizing their potential are slim. That’s true of the thrift savings plan (TSP) that’s available to you as a federal employee.

The TSP is a great opportunity to store away your hard-earned money for retirement, and in many ways, it works similarly to a 401(k). But like many retirement plans, there is fine print, details to note, and ways to utilize it more effectively. Here’s what you need to know to make the most of your thrift savings plan.

How the Thrift Savings Plan Works

Just like a 401(k), a TSP offers participants the opportunity to divert some of their income into a defined contribution program. For federal employees, the government contributes money an employee designates into a retirement account on their behalf.

There are both traditional TSPs and Roth TSPs available. Having a traditional TSP means that your contributions, employer match, and investment growth are all pre-tax. When you make a withdrawal down the road, the taxes will be due based upon the applicable tax rate at the time you take the money out.

Roth TSP accounts are post-tax, so all contributions are taxed as income at the time that the contributions are made. The benefit, however, is that no tax will be due at the time you withdraw on either your contributions or your growth. It should be noted that all employer matches can only be made in a traditional account. This will result in having both a Roth and a traditional account open if you choose to make contributions into a Roth.

What Do I Need to Know About Contributions?

The contribution limit for the TSP is $19,500 in 2021, with a $6,500 catch-up contribution available for employees over age 50. RMDs start at age 72 for traditional versions of both account types, though the TSP allows you to sidestep this if you haven’t yet retired from your federal employment.

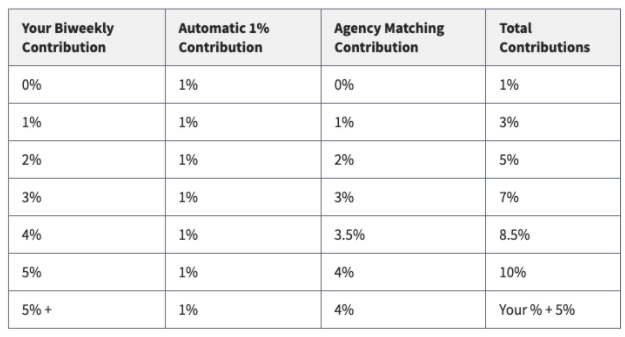

Like many employers, the plan offers a match, up to 5% when an employee also contributes 5% (a full match on the first 3%, and a 50% match on the last 2%). This is in addition to the automatic 1% contribution your agency makes on your behalf each pay period. (1) For this reason, make sure you change your automatic deduction to 5% to take full advantage of this benefit.

You become vested after either two or three years, depending on which branch of the government you work for.

What Are My Plan Options?

One stark contrast we see between 401(k) accounts and the TSP is the wide variety of index options available to most 401(k) plans, versus the slim choices available to the TSP. The TSP offers a scant selection of five investment options, only four of which are index funds. (2) While stable and typically very conservative, the lack of options may leave some employees feeling like they have a lack of control over their portfolio.

That being said, one advantageous difference in favor of a TSP is the generally lower costs associated with investments within the account. 401(k)s can often have high and sometimes hidden maintenance and administrative fees. With relatively low fees, the TSP participant often enjoys the opportunity to keep more of their contributions growing for their retirement.

Everything Else You Need to Know

While this article hits most of the highlights, the TSP plan is comprehensive and complex. If you want to learn about every detail to make the most of your opportunities, you need a professional to walk you through your options.

At Pinnacle Family Advisors, we provide experienced and objective guidance to walk you through setting up your TSP in a way that will work best for your unique situation. To get started, schedule your complimentary introductory meeting by emailing me at [email protected], calling (417) 351-2942, or using my online calendar.

About Michael

Michael Vaughn is a Certified Financial Planner™ (CFP®) and Vice President at Pinnacle Family Advisors (PFA) with 20 years of industry experience. Before joining the PFA family, he served clients with investment management and retirement planning at The Mutual Fund Store for 14 years. Michael graduated from Missouri State University with a bachelor’s degree in business administration and management and earned his CFP® designation in 2004. He also served 20 years in the Missouri National Guard, retiring in 2007 as a Major. He currently volunteers on the board of directors for Good Dads and Fellowship of Christian Athletes. Michael is married to Lori and they have two daughters. To learn more about Michael, connect with him on LinkedIn.

____________

(1) https://www.tsp.gov/making-contributions/contribution-types/

(2) https://www.investopedia.com/articles/investing/061113/breaking-down-tsp-investment-funds.asp